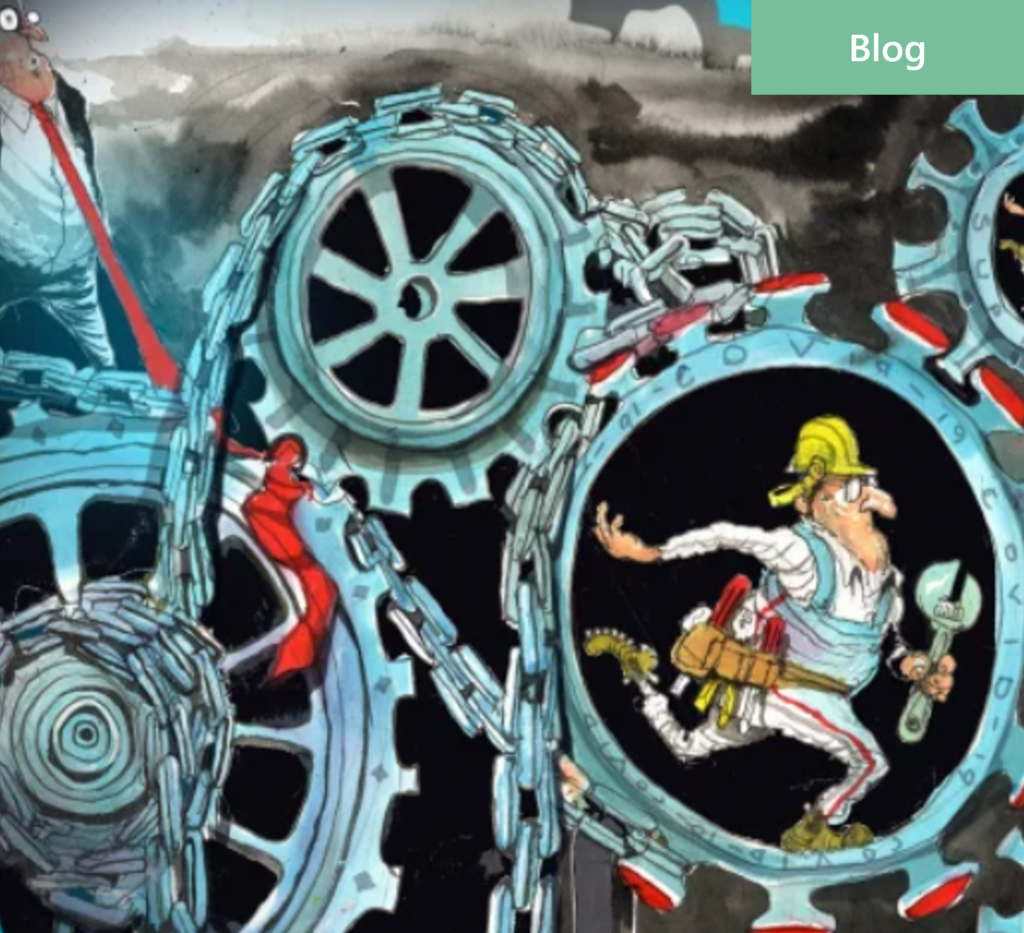

Boosting Business Value through Operational Efficiency

As business owners and entrepreneurs in Australia seek to increase the value of their businesses and maximise their growth potential, one aspect which warrants particular attention is operational efficiency. By